Solution configurability, global reach, and customer service highlighted as key strengths of Planon’s Platform for Asset & Maintenance Management

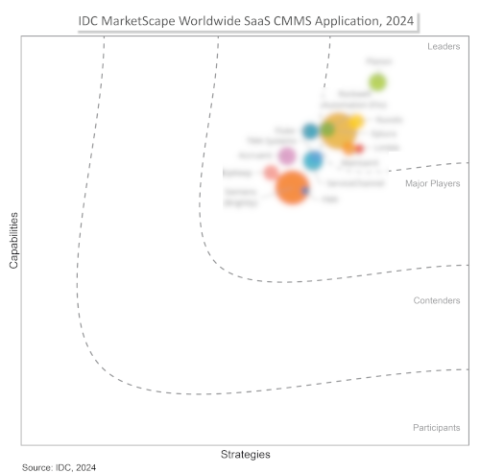

9 September 2024 – Planon is proud to again be named a ‘Leader’ in the IDC MarketScape: Worldwide SaaS Computerised Maintenance Management System (CMMS) Application 2024 Vendor Assessment. The IDC MarketScape recognises Planon’s Asset & Maintenance Management as a leading solution for its capabilities and long-term vision and strategy.

‘I’m extremely proud that IDC has named Planon as a worldwide leader in CMMS in its latest MarketScape report,’ said Peter Ankerstjerne, CEO of Planon. ‘This report evaluates our Asset & Maintenance Management (AMM) solution based on its current functionality and capabilities, as well as its future vision and strategy. We believe this recognition validates our commitment to delivering the best solution for our customers’ building operation needs. AMM is not just a vital component of Planon’s fully IoT-enabled Integrated Workplace Management Solution (IWMS) platform; it also serves as a fundamental element of Planon and represents the foundation of our organisation. We always strive to stay ahead of the latest market trends and customer requirements and I see this as a testament to the strong effort of the entire organisation.’

The IDC MarketScape Worldwide SaaS CMMS Application Vendor Assessment is a valuable resource for evaluating CMMS vendors and understanding key criteria for choosing a CMMS and technology partner.

Source: "IDC MarketScape Worldwide SaaS Computerized Maintenance Management System Application 2024 Vendor Assessment", By: Brian O’Rourke, August 2024, IDC # US51359024*

‘For organisations currently considering investing in a CMMS platform, IDC encourages tech buyers to look for a solution that can at a minimum support reactive, planned, and condition-based maintenance capabilities. For strategic and forward-thinking organisations, IDC encourages teams to consider key topics such as solution configurability, predictive maintenance, AI, location intelligence, ESG and sustainability. IDC recognises Planon as a leader in these capabilities,’ says Brian O’Rourke, Research Manager, Enterprise Asset Management & Smart Facilities at IDC.

The IDC MarketScape report underscores several of Planon’s strengths, including:

- Planon’s notable global presence and growth strategy, which enable the company to consistently add both multinational and regional customers, leveraging its open platform approach and extensive ecosystem of implementation partners worldwide.

- Planon is among the strongest vendors in several areas of customer service, including dedicated account management, live chat, chatbot, 24/7 live support, and live support for multiple languages.

- Planon is one of the more configurable CMMS solutions available, with strengths that include the ability to create custom fields, configure access based on role, personalise each user's landing page, and configure custom CMMS workflows and approval processes. The company also provides Planon Accelerator, which is an out-of-the-box, preconfigured, best practice implementation.

A free excerpt of the report on Planon can be obtained via the link below:

IDC MarketScape: Worldwide SaaS CMMS Application Vendor Assessment 2024 (doc #US51359024, August 2024)

*IDC MarketScape vendor analysis model is designed to provide an overview of the competitive fitness of ICT suppliers in a given market. The research methodology utilizes a rigorous scoring methodology based on both qualitative and quantitative criteria that results in a single graphical illustration of each vendor’s position within a given market. The Capabilities score measures vendor product, go-to-market and business execution in the short-term. The Strategy score measures alignment of vendor strategies with customer requirements in a 3-5-year timeframe. Vendor market share is represented by the size of the circles. Vendor year-over-year growth rate relative to the given market is indicated by a plus, neutral or minus next to the vendor name.